A nascent biochar industry is emerging in connection with biomass power technologies that coproduce electricity and char via gasification and pyrolysis.

A single source of biomass could ostensibly create multiple revenue streams, with systems calibrated to produce more electricity, biochar or bio-oil when one is more profitable than the other.

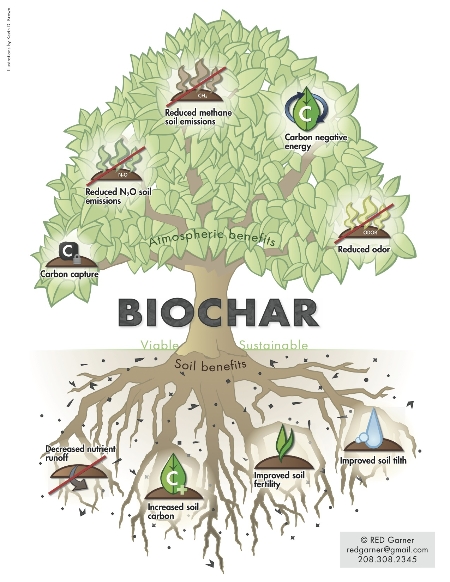

Research shows biochar improves soil fertility, decreases water pollution and even mitigates heavy metals. The charcoal-like substance has enthusiastic support from researchers and the sustainability movement, but it has been slow to commercialize.

“This is a brand new industry with a chicken-and-egg problem,” says Kelpie Wilson, project development director of the International Biochar Initiative. “You have lots of research but not a lot of supplies.”

For now, however, large biomass power producers are neither equipped to create biochar nor are they interested in making it. The creation of biochar leaves less energy for power production. Also, there is no established market for biochar in industrial agriculture.

Supporters say biomass operators will soon see more revenue from biochar since organic farmers and garden centers are starting to demand it for soil blending. EPA clean water regulations could open nutrient credit exchanges to biochar, setting the stage for a biochar boom in agriculture and environmental mitigation.

Focus on Power Production

While those biochar markets evolve, pyrolysis and gasification operators are gaining ground with distributed energy systems that serve businesses in need of electricity and biomass disposal.

Pyrolysis entails heating woody biomass or manure in kilns with no oxygen. Gasification heats biomass with limited oxygen. Heat breaks down wood or manure, creating synthetic gas, or syngas, which can be burned for process heat or steam. Conventional biomass power combusts feedstock into ash; pyrolysis can convert biomass into a phosphorous-rich char that retains moisture in soil.

Phoenix Energy manufactures gasification systems that produce biochar while generating electricity with modified diesel engines. Its 500-kW system — the country’s first grid-tied gasifier with air permits — uses waste wood to generate 100 percent of electricity for a pallet company in Merced, Calif.

“We make a business out of this because it is an ROI-driven investment,” Phoenix Energy CEO Greg Stangl said.

The customer pays about 20 cents per kWh retail for electricity generated on site, while Phoenix Energy incurs about 6 cents per kWh in expenses for feedstock and operations. It earns about 11 cents per kWh wholesale by selling to the grid. Phoenix Energy is awaiting permits for two 1-MW systems that will use orchard trimmings to sell electricity to agriculture facilities in Northern California.

“You do not need a subsidy to make this work for that subset of customers who use power and have biomass fuel,” Stangl said.

That California business model would not necessarily work in states with lower rates.

Scalability of Biochar

Phoenix Energy generates 5 to 20 percent char by volume of woody biomass feedstock. The 500-kW system produces one ton of biochar per day, and that sells for less than $100. Competing systems can generate far more biochar, however.

“In dollar terms, it doesn’t even show up on the radar screen,” Stangl said. “I really want to believe that biochar will be more profitable but, until you start making $3,000 per ton, it’s worth more to make electricity.”

Biochar typically sells for $200 to $600 per ton, according to the International Biochar Initiative.

The biochar/biomass power industry could learn about scalability from the market for poultry litter and manure ash. Livestock waste ash lacks nitrogen but contains phosphorous, so it is sold as a fertilizer amendment.

Fibrowatt’s 55-MW plant in Minnesota creates 100,000 tons of ash from 600,000 tons of poultry litter every year. The ash sells for $90 per ton. Prices have fluctuated between $45 and more than $100. Still, the ash amounts to less than 20 percent of revenues.

“We’ll never build a plant based on the output of ash,” said Paul Kelso, a Fibrowatt spokesman. “I just don’t see how biochar or ash could ever be a driver for a plant.”

Nutrient Credit Exchange

Manure and poultry litter biomass still hold promise for biochar in states mandated by the EPA to begin “nutrient diets” to reduce runoff of nitrogen and phosphorous. The oxygen-depleting nutrients are known to create “dead zones” in the Gulf of Mexico.

Nutrients in watersheds often come from livestock and poultry farms. Efforts to clean Chesapeake Bay spawned a nutrient credit exchange in nearby states. In Virginia, the trading scheme is limited to “point sources” like wastewater districts, but the legislature could include biochar trading when it opens the exchange to “non-point” sources.

Peter Thomas, a nutrient credit broker with Coaltech Energy USA, predicts large-scale production of biochar within 12 months. Many projects, he says, will develop near the Chesapeake Bay and California dairy farms.

“The generation of renewable energy, the gasification of poultry litter and dairy manure to produce phosphorus-rich biochar, and nutrient trading are all about to become inextricably linked, resulting in an economically viable model,” Thomas said.

Conventional biomass power plants that burn manure and poultry litter also hope to benefit.

“There would be some value in us removing poultry litter so nutrients are not going into the bay,” Fibirowatt’s Kelso said.

Environmentalists, however, want the program to focus on biochar credits — Fibrowatt has been met with opposition throughout the Chesapeake region.

Erich J. Knight, a biochar advocate in Virginia, opposed Fibrowatt’s planned poultry litter plant in Page County, in part, because it would have increased emissions and required trucking manure long distances. Knight said many who opposed the large plant support smaller gasification systems that coproduce biochar and electricity.

“Local, decentralized plants of 1 MW to 15 MW make way more sense from all perspectives,” Knight said.

Regulatory Climate

The biomass power industry faces long-term uncertainty since the EPA said biomass-fired power plants may require the same CO2 permits for coal-fired plants. Gasification and pyrolysis leaders say they can help the industry prove to a skeptical public that biomass can be a clean energy source.

“We generate a lot less particulates because there is never direct flame contact” with biomass, says Mike Ballantine, president of International Tech Corp. (ITC). “In a combustion chamber, oxygen and turbidity generate a lot of particulates.”

The company manufactures thermal recovery units (shown below) that use pyrolysis to ignite flue gas, creating steam that powers turbines. A unit requiring 4,000 pounds of green waste per hour generates two tons of biochar and 2,500 kilowatt hours of electricity. ITC hopes to announce a contract with a major corporation in coming months.

Fibrowatt’s Minnesota plant released 445 tons of carbon monoxide and 361 tons of nitrogen oxides, among other emissions in 2009, according to the Minnesota Pollution Control Agency. Fibrowatt gets its poultry litter — a mix of chicken droppings, feed and bedding — from farms across Minnesota.

Homeland Renewable Energy Inc., Fibrowatt’s parent company, developed a process for lowering nitrogen oxide and particulates by recycling water and waste heat captured from gaseous emissions.

“We can meet clean air requirements,” Kelso said.

He worries that multiple pyrolysis and gasification systems might evade the scrutiny and regulation that comes with a large biomass plant.

“Our downdraft gasification is inherently lower in nitrous oxide emissions than natural gas,” said Phoenix Energy’s Stangl. “We have clearly demonstrated beyond a shadow of a doubt that we can get an air permit in the toughest place in the U.S.”

Understanding Ag Science

A 2010 study in Nature Communications says biochar is 20% more effective at mitigating climate change than bioenergy because it slows the rate carbon returns to the atmosphere while increasing agricultural productivity.

Biochar comes with inherent competing interests between biomass power and agriculture, but research and outreach efforts are starting to close the gap in understanding. Farmers say they will express greater interest in biochar coproduced with electricity if it is rooted in agriculture science.

“You don’t want to create a negative legacy by applying the wrong char to the wrong soil,” says Jeff Novak, a USDA soil scientist.

His research shows char produced at temperatures of 300 to 400 C have good qualities, but chars produced at temperatures exceeding 600 C can become alkaline. Chars that improve southern soil can also lead to nutrient imbalances in other regions.

Recognizing these concerns, the International Biochar Initiative has begun an effort to standardize and certify char products.

“Electricity production isn’t our focus, although we are very interested in energy capture when biochar is produced,” says Wilson, the group’s project development director. “The ultimate goal is to have an impact on climate change.”

Source: renewableenergyworld

Follow

Follow