Marrying Gas and Renewables A Turkish developer recently announced that it would build a new power plant using technology from GE that matches wind and solar generation to the output of a highly responsive natural gas turbine, all integrated in one package with the hardware and software to mesh its output with the grid. GE is apparently calling this scheme IRCC, for “integrated renewables combined cycle“, adding yet another acronym to our growing list of energy choices. This development looks interesting from a technical perspective, but also for what it suggests about GE’s view of the future market for generating equipment and power delivery.

The International Energy Agency’s “Golden Age of Natural Gas” scenario remains a question mark, rather than a certainty, but if gas is to serve as the key fuel for bridging between our high-emission present and the low-emission future, then we’re likely to see more installations like the one in Turkey emphasizing the synergies between gas and renewables, rather than the tough competition gas is giving renewables in some markets. The IRCC–not to be confused with an IGCC or the IPCC–is interesting because it goes well beyond the idea of using gas-fired power plants to back up the naturally variable output of wind farms and utility-scale solar arrays.

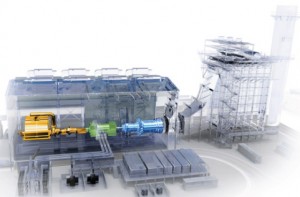

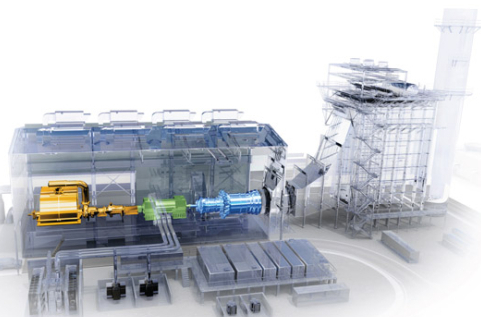

The IRCC concept is built around a new combined cycle gas turbine, the Flex-Efficiency 50, with an impressive capability to ramp up and down, as needed, with minimal loss of either efficiency or emissions performance. And thanks to the energy technology portfolio the company has built up over the last decade, GE is able to offer one-stop shopping with GE wind turbines and a solar thermal generating module from eSolar, in which GE has recently invested. The gas turbine/solar thermal hybridization looks especially useful in maximizing plant efficiency and incorporating solar thermal power into the grid at the lowest possible cost, by avoiding the expense of an extra steam turbine and generator. If all this works as advertised, the grid operator shouldn’t know or care whether the power being dispatched was generated using wind, sun, or gas.

Before you confuse this posting for a GE ad, I should note that at least in the configuration chosen for the Turkish site most of the power from this integrated plant would still be generated by the gas turbine, which has 10 times the peak output of the concentrated solar power module and more than 20 times the rated power of the small wind farm tied into it. By the time you account for the capability of the gas turbine to run 24/7 when necessary, compared to typical capacity factors of 25-40% for wind and up to 25% for solar, the proportion of the IRCC’s annual megawatt-hours generated from gas could exceed 95%. Nor is GE the only firm bringing turbines like this to market. So it’s an impressive step, though more of an incremental than revolutionary one. However, with its inherent flexibility, I wouldn’t be surprised if this type of gas turbine could effectively integrate a much larger quantity of renewable generation on the grid outside the IRCC’s fence, particularly after the operating experience of the first few installations has been absorbed.

GE’s timing in introducing its IRCC concept could prove especially apt. Not only does the Flex-Efficiency turbine look useful for helping to meet California’s aggressive new 33% renewable electricity target, but the 50-cycle version featured in GE’s marketing materials–likely minus the solar thermal module–could be just what Germany needs, now that its government has begun to come to grips with the quantity of new fossil generation that’s going to be required to make up for the post-Fukushima accelerated retirement of its nuclear power plants.

Follow

Follow As we’ve mentioned in a previous article, General Electric is thinking of expanding its presence worldwide. Their plans now include a 530 megawatt hybrid power plant in Turkey.

As we’ve mentioned in a previous article, General Electric is thinking of expanding its presence worldwide. Their plans now include a 530 megawatt hybrid power plant in Turkey. The IEA report, for example, concluded that increasing use of gas puts greenhouse gas emissions on a trajectory to stabilize at 650 parts per million, which would bring a long-term temperature rise of 3.5 degrees Celsius. This figure, by any measure, is an unacceptably high level of warming and made Climate Progress blogger Joe Romm,

The IEA report, for example, concluded that increasing use of gas puts greenhouse gas emissions on a trajectory to stabilize at 650 parts per million, which would bring a long-term temperature rise of 3.5 degrees Celsius. This figure, by any measure, is an unacceptably high level of warming and made Climate Progress blogger Joe Romm,